How to Invest in Cryptocurrencies & Is It Worth It?

Cryptocurrencies have really revolutionized the financial landscape, offering individuals new opportunities for investment and financial growth. As we start 2024, the world of cryptocurrencies continues to evolve and attract both seasoned investors and newcomers alike. Today I will share with you my thoughts on how to invest in cryptocurrencies, highlighting the pros and cons of this interesting asset class.

Cryptocurrencies operate on a decentralized network known as blockchain, which ensures transparency, security, and immutability. Bitcoin, Ethereum, Cardano, and other popular cryptocurrencies have gained significant traction, making headlines with their explosive growth and potential for long-term profitability.

Pros of Investing in Crypto

- Potential for High Returns: Cryptocurrencies have witnessed remarkable growth over the years, with early investors reaping substantial profits. Bitcoin, for example, has experienced significant price surges, turning many early adopters into millionaires. This potential for high returns is a major driving factor for investors.

- Diversification of Investment Portfolio: Cryptocurrencies offer an opportunity to diversify investment portfolios beyond traditional assets like stocks, bonds, and real estate. By adding cryptocurrencies to your portfolio, you can potentially reduce risk and increase potential returns.

- Global Accessibility: Unlike traditional financial systems, cryptocurrencies are accessible to anyone with an internet connection. This opens up investment opportunities to individuals around the world, regardless of their location or financial background.

- Innovation and Technological Advancement: Investing in cryptocurrencies allows you to support and be a part of the cutting-edge technology that underpins blockchain networks. This innovative technology has the potential to disrupt various industries and reshape the future of finance.

Cons of Investing in Crypto

- Volatility: Cryptocurrencies are notorious for their volatility, with prices frequently experiencing significant fluctuations. While this volatility presents opportunities for profit, it also carries the risk of substantial losses. Investors must be prepared for price swings and have a long-term investment strategy in place.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is still evolving, with governments worldwide grappling to establish comprehensive guidelines. Regulatory changes can impact the value and legality of cryptocurrencies, making it essential for investors to stay informed about legal developments.

- Security Risks: Investing in cryptocurrencies exposes you to security risks such as hacking, scams, and theft. Ensuring the safety of your investments requires implementing robust security measures, such as using hardware wallets, enabling two-factor authentication, and practicing good password hygiene.

- Taxation Complexities: Cryptocurrency investments can introduce complexities to your tax obligations. Different jurisdictions have varying regulations regarding the taxation of cryptocurrencies. It is crucial to consult with tax professionals to understand and comply with the tax requirements in your jurisdiction.

How to Invest in Cryptocurrencies in 2024

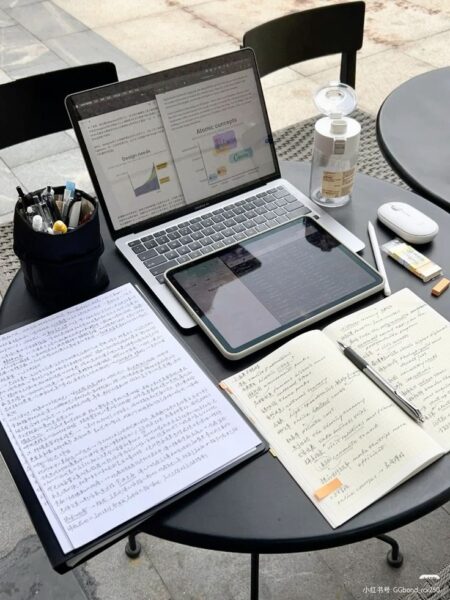

- Research and Educate Yourself: Before investing in cryptocurrencies, it is essential to thoroughly research and understand the fundamentals of blockchain technology, different cryptocurrencies, and their potential use cases. Stay updated with industry news, follow reputable sources, and engage with the cryptocurrency community.

- Choose the Right Crypto Platform: Selecting a reliable and user-friendly crypto platform is crucial. Consider factors such as security measures, supported cryptocurrencies, fees, ease of use, and customer support. Popular platforms include Coinbase, Binance, and Kraken.

- Set Up a Wallet: To store your cryptocurrencies securely, set up a cryptocurrency wallet. Wallets come in various forms, including hardware wallets, software wallets, and online wallets. Hardware wallets, such as Ledger and Trezor, are considered the most secure option.

- Select a Crypto Exchange: A crypto exchange allows you to buy, sell, and trade cryptocurrencies. Look for exchanges that offer a wide range of cryptocurrencies, have a good reputation, provide liquidity, and have strong security measures in place.

- Create an Investment Strategy: Define your investment goals, risk tolerance, and time horizon. Determine the percentage of your portfolio you are willing to allocate to cryptocurrencies. Consider diversifying your investments across different cryptocurrencies to mitigate risk.

- Conduct Due Diligence: Before investing in a specific cryptocurrency, research its team, technology, use case, market competition, and potential for adoption. Analyze the project’s whitepaper, roadmap, and community engagement. Look for red flags and seek expert opinions if necessary.

- Monitor Your Investments: Keep track of your cryptocurrency investments regularly. Stay updated with market trends, news, and events that may impact prices. Consider using portfolio tracking tools and setting price alerts to stay informed.

Conclusion

Investing in crypto can be a rewarding venture, but it requires careful consideration and due diligence. In 2024 the potential for high returns and the opportunity to diversify investment portfolios make cryptocurrencies an attractive asset class. However, investors must be aware of the risks associated with volatility, regulatory uncertainties, security, and taxation complexities.

By researching, selecting the right platforms, and following best practices for security and risk management, investors can position themselves for success in the world of cryptocurrencies. Remember to stay informed, adapt your investment strategy as needed, and always invest within your means. Cryptocurrencies have the potential to reshape the future of finance, and by investing wisely, you can be part of this journey.

![Top 25+ Elder Care Business Opportunities [Updated 2025] Top 10 Elder Care Business Opportunities](https://businessher.com/wp-content/uploads/2025/01/1b416bb2f666673524a40ab7f587ec5c-150x150.jpg)

![How to Validate Your Business Idea Before Launching Your Startup [Updated 2025] How to Validate Your Business Idea Before Launching Your Startup](https://businessher.com/wp-content/uploads/2023/11/af056cac8da4cac8235dd9571a775c97.jpg)

Post Comment