Porter’s Five Forces Analysis: Example

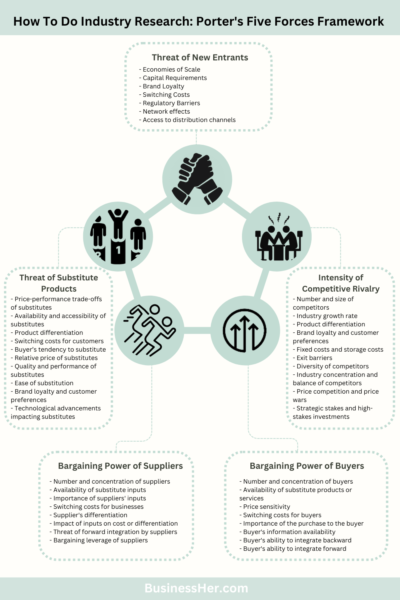

Industry analysis is crucial for your business because it helps you understand the environment in which your business operates and get the information about your competitor landscape. This way you can make better strategic decisions that will drive your business growth. The best method to conduct such research – use Porter’s Five Forces analysis example of which we will explore further.

Why do you need to do industry analysis for your business

- Know Your Competitors: By analyzing your industry, you can identify who your competitors are, what they offer, and how they operate. This helps you figure out what makes your business different and how you can compete effectively.

- Spot Opportunities and Threats: Industry analysis helps you identify trends, opportunities, and potential threats in your market. For example, if there’s a growing demand for a certain product or service, you can capitalize on that opportunity. At the same time if there’s increased competition or changing customer preferences, you can adjust your strategy accordingly.

- Plan Your Strategy: Industry analysis provides the information you need to develop a solid business strategy. Whether it’s pricing, marketing, or product development, understanding your industry helps you make informed decisions that drive your business forward.

- Manage Risks: By staying informed about your industry, you can anticipate and mitigate risks that may impact your business. Whether it’s regulatory changes, economic downturns, or technological advancements, being aware allows you to adapt and minimize negative impacts on your business.

One of the best frameworks for industry analysis – Porter’s Five Forces analysis example of which we will discuss in this article. You can learn more about analysis of each category in this article, here we mostly focus on examples for them.

Threat of New Entrants

Threat of New Entrants means considering how easy or hard it is for new businesses to start up and compete in your industry. If it’s easy for new businesses to enter, existing companies might have to work harder to keep customers and make money. But if it’s hard for new businesses to enter, existing companies might have a better chance to keep their customers and make a profit without worrying too much about new competition.

Porter’s Five Forces analysis example for Threat of New Entrants section below.

High Threat of New Entrants Examples:

- Software Development: The software development industry often faces a high threat of new entrants due to relatively low barriers to entry. With the availability of open-source tools and online resources, new software startups can emerge quickly. Additionally, the increasing demand for specialized software solutions and the prevalence of remote work have lowered barriers to entry further, allowing new players to enter the market relatively easily.

- Coffee Shop: The coffee shop industry is another example of an industry with a high threat of new entrants. While there may be significant upfront costs associated with leasing space, purchasing equipment, and obtaining permits, the relatively low barriers to entry make it feasible for aspiring entrepreneurs to open their own coffee shops. The popularity of coffee culture and the widespread appeal of coffee-related products attract new entrants to the market regularly.

Low Threat of New Entrants Examples:

- Aircraft Manufacturing: The aircraft manufacturing industry typically faces a low threat of new entrants due to the significant barriers to entry, including high capital requirements, stringent regulatory standards, and extensive research and development costs. Established companies like Boeing and Airbus dominate the market, making it challenging for new players to enter and compete effectively.

- Pharmaceuticals: The pharmaceutical industry is characterized by substantial barriers to entry, such as extensive research and development processes, stringent regulatory approval requirements, and high intellectual property barriers. Developing new drugs and obtaining regulatory approval can take years and require substantial financial investments, which deter many potential new entrants. As a result, a few large pharmaceutical companies dominate the market, reducing the threat of new competitors.

Bargaining Power of Suppliers

The Bargaining Power of Suppliers is all about how much control your suppliers have over your business. If your suppliers have a lot of power, they can demand higher prices or set strict terms, making it harder for you to negotiate. But if you have more power, you can negotiate better deals and get what you need at a fair price. It’s like a tug-of-war between you and your suppliers, with the outcome affecting your costs and ultimately your profits.

Porter’s Five Forces analysis example for Bargaining Power of Suppliers section below.

High Bargaining Power of Suppliers:

- Automobile Manufacturing: In the automobile manufacturing industry, suppliers of essential components such as engines, transmissions, and electronic systems often have significant bargaining power. Suppliers may control access to specialized materials or technologies, allowing them to dictate terms and prices to manufacturers. For example, a semiconductor shortage in the automotive industry in 2021 resulted in increased prices and production disruptions, highlighting the significant bargaining power of semiconductor suppliers.

- Soft Drink Bottling: Soft drink bottlers rely heavily on suppliers of packaging materials such as bottles, cans, and labels. Suppliers in this industry may have substantial bargaining power due to their control over critical inputs and limited alternative sources. Changes in packaging material prices or availability can directly impact bottlers’ costs and profitability, giving suppliers leverage in negotiations.

Low Bargaining Power of Suppliers:

- Retail Industry: In the retail industry, suppliers of consumer goods typically have lower bargaining power due to the presence of numerous suppliers and readily available substitute products. Retailers can easily switch between suppliers or source products from multiple suppliers to obtain favorable terms and prices. As a result, suppliers must compete on factors such as quality, price, and delivery terms to maintain relationships with retailers.

- Fast Food Chains: Fast food chains rely on suppliers of ingredients such as meat, vegetables, and packaging materials. While certain suppliers may have some degree of bargaining power, the competitive nature of the fast food industry and the availability of multiple suppliers mitigate supplier influence. Fast food chains can negotiate pricing and contract terms based on their purchasing volume and may switch suppliers if better alternatives emerge, reducing supplier bargaining power.

Bargaining Power of Buyers

The Bargaining Power of Buyers is about how much influence your customers have over your business. When buyers have a lot of power, they can demand lower prices, better quality, or more services. This puts pressure on businesses to meet these demands to keep customers happy. However, when businesses have more power, they can set prices and terms more favorably, making it harder for buyers to negotiate. It’s like a negotiation between you and your customers, with both sides trying to get the best deal possible

Porter’s Five Forces analysis example for Bargaining Power of Buyers section below.

High Bargaining Power of Buyers:

- Supermarket Industry: In the supermarket industry, buyers (consumers) typically have high bargaining power due to the abundance of substitute products and the presence of multiple competitors. Consumers can easily compare prices and quality across different supermarkets and may switch between stores based on promotional offers, discounts, or loyalty programs. As a result, supermarkets often face pressure to keep prices low and offer competitive deals to attract and retain customers.

- Smartphone Industry: In the smartphone industry, buyers have significant bargaining power due to the availability of a wide range of smartphone brands and models. Consumers can compare features, prices, and reviews online and may switch between brands based on their preferences and budget constraints. Smartphone manufacturers must continuously innovate and offer competitive pricing and features to attract and retain customers in this highly competitive market.

Low Bargaining Power of Buyers:

- Healthcare Industry: In the healthcare industry, buyers (patients) often have limited bargaining power due to the necessity and urgency of medical services and treatments. Patients may have little choice but to accept the prices and terms set by healthcare providers, especially in cases of emergency or specialized care. Additionally, health insurance companies, acting as intermediaries between patients and providers, negotiate prices and coverage terms on behalf of their members, further limiting individual patient bargaining power.

- Aerospace Industry: In the aerospace industry, buyers (airlines and governments) typically have limited bargaining power due to the specialized nature of aerospace products and long-term contracts involved in aircraft purchases. Airlines require aircraft that meet strict safety and performance standards, and governments often impose regulations and certification requirements. As a result, aerospace manufacturers can negotiate prices and terms based on the unique specifications and requirements of each buyer, reducing buyer bargaining power.

Threat of Substitute Products or Services

The Threat of Substitute Products or Services is about the possibility of other options that customers might choose instead of yours. If there are many similar options available, customers might switch to a different product or service that meets their needs just as well or even better. This threat encourages businesses to differentiate their offerings and create unique value to retain customers. It’s like knowing that if your favorite pizza place is closed, you can always choose another nearby restaurant or even make pizza at home.

Porter’s Five Forces analysis example for Threat of Substitute Products or Services section below.

High Threat of Substitute Products or Services:

- Streaming Services: The entertainment industry, particularly streaming services like Netflix, Amazon Prime Video, and Disney+, faces a high threat of substitute products. With the increasing popularity of online streaming platforms, consumers have access to a wide variety of content at their fingertips. Alternative forms of entertainment such as cable television, video games, and social media also pose significant substitutes, making it crucial for streaming services to continuously innovate and offer unique content to retain subscribers.

- Ride-Sharing Services: Ride-sharing services like Uber and Lyft operate in an industry with a high threat of substitute services. Traditional taxi services, public transportation options, and personal vehicle ownership provide viable alternatives to ride-sharing for consumers seeking transportation. Additionally, advancements in autonomous vehicle technology and alternative modes of transportation, such as electric scooters and bicycles, further increase the threat of substitutes in the ride-sharing industry.

Low Threat of Substitute Products or Services:

- Pharmaceuticals: The pharmaceutical industry faces a relatively low threat of substitute products due to the specialized nature of pharmaceutical drugs and the rigorous regulatory requirements for drug approval. Prescription medications often have no direct substitutes, particularly for treating complex medical conditions or diseases. While generic alternatives may exist for some medications, brand-name drugs with unique formulations and patents typically maintain a competitive advantage and face limited substitution from generics.

- Higher Education: The higher education industry, encompassing colleges and universities, experiences a low threat of substitute services. While online learning platforms and vocational training programs offer alternative educational options, traditional higher education institutions provide unique benefits such as academic accreditation, campus resources, and networking opportunities. The prestige associated with degrees from established universities and the social aspects of campus life contribute to the low threat of substitution for traditional higher education.

Intensity of Competitive Rivalry

The Intensity of Competitive Rivalry is about how fierce the competition is in your industry. When rivalry is intense, businesses fight hard for customers, often through price wars, aggressive marketing, or constant innovation. This can make it challenging for businesses to stand out and make a profit. However, when rivalry is low, businesses may enjoy more stability and higher profits because they face less pressure from competitors.

Porter’s Five Forces analysis example for Threat of Substitute Products or Services section below.

High Intensity of Competitive Rivalry:

- Smartphone Industry: The smartphone industry is characterized by high intensity of competitive rivalry due to the presence of numerous brands vying for market share. Companies like Apple, Samsung, Huawei, and Xiaomi compete aggressively to differentiate their products through features, design, and marketing strategies. Continuous innovation, frequent product launches, and price competition are common tactics employed by smartphone manufacturers to maintain or gain market leadership. As a result, the industry experiences rapid technological advancements and frequent shifts in market dynamics.

- Airline Industry: The airline industry faces intense competitive rivalry driven by factors such as price competition, route expansion, and service differentiation. Airlines compete fiercely for passengers by offering competitive fares, frequent flyer programs, and enhanced customer experiences. Low-cost carriers like Southwest Airlines and Ryanair have intensified competition by challenging traditional legacy carriers on pricing and operational efficiency. The industry’s high fixed costs, limited product differentiation, and cyclical demand exacerbate competitive pressures, leading to constant battles for market share and profitability.

Low Intensity of Competitive Rivalry:

- Pharmaceutical Industry: The pharmaceutical industry experiences relatively low intensity of competitive rivalry compared to other sectors. While competition exists among pharmaceutical companies, factors such as patent protection, regulatory barriers, and high research and development costs limit direct competition for specific drugs. Companies focus on developing innovative therapies and securing intellectual property rights to differentiate their products and establish market exclusivity. Additionally, the long development timelines and stringent regulatory approval processes reduce the frequency of new entrants and mitigate competitive pressures within the industry.

- Utilities Industry: The utilities industry, encompassing sectors like water, electricity, and gas distribution, exhibits low intensity of competitive rivalry. Utilities typically operate within regulated environments where monopolies or oligopolies are common due to high infrastructure costs and government oversight. Regulatory agencies set pricing and service standards to ensure reliability, affordability, and equitable access for consumers. While some competition exists in deregulated markets or for specific services like renewable energy generation, overall competitive rivalry remains relatively subdued compared to other industries.

Hopefully, this article was useful to you and now you understand this framework better. If you need more Porter’s Five Forces analysis example or explanation, let me know in the comments.

![Top 25+ Elder Care Business Opportunities [Updated 2025] Top 10 Elder Care Business Opportunities](https://businessher.com/wp-content/uploads/2025/01/1b416bb2f666673524a40ab7f587ec5c-150x150.jpg)

Post Comment