Industry Analysis with Porter’s Five Forces Framework: Explanation with Examples

Porter’s Five Forces Framework is a tool used by businesses to understand the competitive dynamics of an industry. It analyses five key factors that influence how competitive an industry is and how profitable companies within it can be. These factors include the threat of new competitors entering the market, the bargaining power of buyers and suppliers, the threat of substitute products or services, and the intensity of competitive rivalry among existing firms (these are called Porter’s 5 forces). By analyzing these forces, businesses can identify opportunities and threats within their industry and develop strategies to compete more effectively. To provide an explanation of Porter’s five forces framework, let’s take a look at each of them separately.

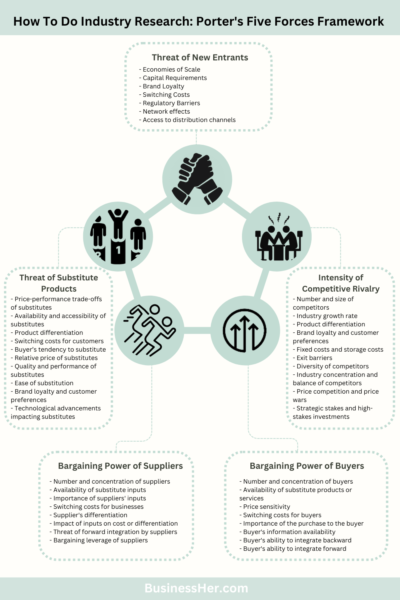

Porter’s Five Forces Framework: Explanation in the Picture

Click to expand if needed.

Threat of New Entrants

The threat of new entrants assesses the barriers to entry that deter new competitors from entering the industry. These barriers may include:

- Economies of Scale: Existing firms may benefit from economies of scale, which lower their average cost per unit and make it challenging for new entrants to compete on price.

- Capital Requirements: Industries with high capital requirements, such as manufacturing or telecommunications, pose significant barriers to entry for new players.

- Brand Loyalty and Switching Costs: Established brands and customer loyalty can make it difficult for new entrants to attract customers away from existing competitors.

- Regulatory Barriers: Government regulations and licensing requirements may create additional barriers to entry, particularly in heavily regulated industries like healthcare or finance.

Example of high threat of new entrants: businesses that don’t require a lot of capital or specific knowledge to enter. For example, new hair salon, coffee shop, marketing agency, etc.

Example of low threat of new entrants: businesses that require a lot of capital or licences to enter. For example, pharmaceuticals industry, healthcare equipment, aircraft manufacturing, banking, etc.

Bargaining Power of Buyers

The bargaining power of buyers refers to the ability of customers to negotiate favorable terms and conditions with industry participants. Key factors influencing buyer bargaining power include:

- Number and Concentration of Buyers: If a small number of buyers account for a significant portion of industry sales, they may have greater bargaining power.

- Availability of Substitute Products: The availability of substitute products or services gives buyers more options and reduces their dependence on specific suppliers.

- Price Sensitivity: Buyers’ sensitivity to price changes can affect their bargaining power. In industries where products are commoditized or undifferentiated, buyers may have greater leverage.

- Switching Costs: High switching costs, such as training requirements or integration expenses, can lock buyers into existing relationships and weaken their bargaining power.

Example of high bargaining power of buyers: when there is an abundance of other good enough options for clients/consumers. Businesses cannot set high prices without justification, because then clients/consumers will just go to their competitors. For example, grocery stores, fast food chains, etc.

Example of low bargaining power of buyers: businesses provide very unique products in terms of real or perceived value. For example, the pharmaceuticals industry, banking, aerospace industry, etc.

Bargaining Power of Suppliers

The bargaining power of suppliers assesses the influence that suppliers wield over industry participants. Key factors influencing supplier bargaining power include:

- Supplier Concentration: If there are few suppliers in the industry or if suppliers have exclusive access to critical inputs, they may have significant bargaining power.

- Availability of Substitute Inputs: The availability of alternative sources for inputs can weaken suppliers’ bargaining power by reducing their ability to dictate terms.

- Cost of Switching Suppliers: High switching costs, such as retooling production lines or retraining employees, can make it difficult for industry participants to switch suppliers and weaken their bargaining power.

- Importance of Inputs: The importance of suppliers’ inputs to industry participants’ operations can affect their bargaining power. Critical or unique inputs give suppliers more leverage in negotiations.

Example of high bargaining power of suppliers: businesses that require specific materials or technologies that only few suppliers can provide (business owner cannot go to just any supplier to get resources for their product). For example, automobile manufacturing, aircraft manufacturing, etc.

Example of low bargaining power of suppliers: businesses that don’t require specific materials or technologies for product creation. For example, coffee shops, retail industry, food industry, etc. Business owner have more power than suppliers, so they can win on price.

Threat of Substitute Products or Services

The threat of substitute products or services examines the likelihood of customers switching to alternatives that offer similar benefits. Key factors influencing the threat of substitutes include:

- Price-Performance Trade-Offs: Customers weigh the benefits and costs of substitute products or services relative to those offered by industry participants.

- Brand Loyalty: Strong brand loyalty can mitigate the threat of substitutes by reducing customers’ willingness to switch to alternative offerings.

- Availability of Close Substitutes: The availability of close substitutes that meet customers’ needs and preferences can increase the threat of substitutes.

- Switching Costs: High switching costs, such as time, effort, or money required to adopt alternative products or services, can deter customers from switching and reduce the threat of substitutes.

Example of high threat of substitute products: there are many available options solving the same problem that the consumer has, and low brand loyalty. For example, retail shops, coffee shops, content streaming services.

Example of low threat of substitute products: businesses provide unique products or consumers will have high costs if they decide to switch to another provider. For example, the pharmaceuticals industry, banking, higher education, etc.

Intensity of Competitive Rivalry

The intensity of competitive rivalry assesses the level of competition among existing industry participants. Key factors influencing competitive rivalry include:

- Number and Size of Competitors: The number and size of competitors in the industry impact the intensity of competition. A large number of small competitors may result in intense price competition, while a few dominant players may engage in strategic battles for market share.

- Industry Growth Rate: Slow industry growth rates can lead to fierce competition as competitors vie for a larger share of a stagnant market.

- Product Differentiation: The degree of product differentiation within the industry can affect competitive rivalry. Industries with highly differentiated products may experience less intense competition than those with commoditized offerings.

- Exit Barriers: High exit barriers, such as significant sunk costs or emotional attachment to the industry, can prolong competitive rivalry by discouraging firms from leaving the market.

Example of high intensity of competitive rivalry: smartphone manufacturing, fast food chains, retail industry.

Example of low intensity of competitive rivalry: pharmaceuticals industry, higher education, aerospace industry, utilities industry, etc.

Conclusion

By understanding and analyzing each component of Porter’s Five Forces Framework in depth, businesses can gain valuable insights into industry dynamics, competitive pressures, and strategic opportunities. By systematically assessing the threats and opportunities within their respective industries, businesses can develop informed strategies to enhance competitive advantage, mitigate risks, and drive sustainable growth. Apply Porter’s Five Forces framework explanation so you could gain strategic advantage over your competitors.

![How to Validate Your Business Idea Before Launching Your Startup [Updated 2025] How to Validate Your Business Idea Before Launching Your Startup](https://businessher.com/wp-content/uploads/2023/11/af056cac8da4cac8235dd9571a775c97.jpg)

Post Comment